In 2025, are we at saturation of incubation spaces in Australia?

Are we at coworking space and innovation hub saturation? After a decade of growth, Australia’s coworking spaces and innovation hubs are entering a new phase.

We may have reached saturation of coworking spaces and innovation hubs in Australia. A contribution with Moudassir Habib to the recent Flex Futures 2025 report highlights the rise, plateau, and recalibration of coworking spaces and innovation hubs across the country.

I started tracking actors in the Australian innovation ecosystem a decade ago when I managed an innovation hub in Ipswich, Queensland and started my PhD on the contribution of spaces to community resilience. The dataset is based on a list of 928 coworking spaces and 297 innovation hubs, with the distinction between the two based on how resources are allocated and their position in the market.

Definitions: A coworking space provides a shared space to work for individuals not part of its organisation. An innovation hub provides its own resources to explicitly advance innovation and entrepreneurship to those outside its organisation. An innovation hub usually but not always includes coworking, but they are different business models. These broad definitions create a wide spectrum and blurred lines that cross over into cafes, libraries, serviced offices, and desks set aside in lobbies of corporate offices or hotels. A systems theory approach looks at the predominant roles and functions of each actor, acknowledging there is subjectivity in interpretation.

The methodology is manual and, while substantial and representative, will never be a complete list of all spaces. Further details about the methodology, including limitations and caveats, are in the Flex Futures report.

Growth rates

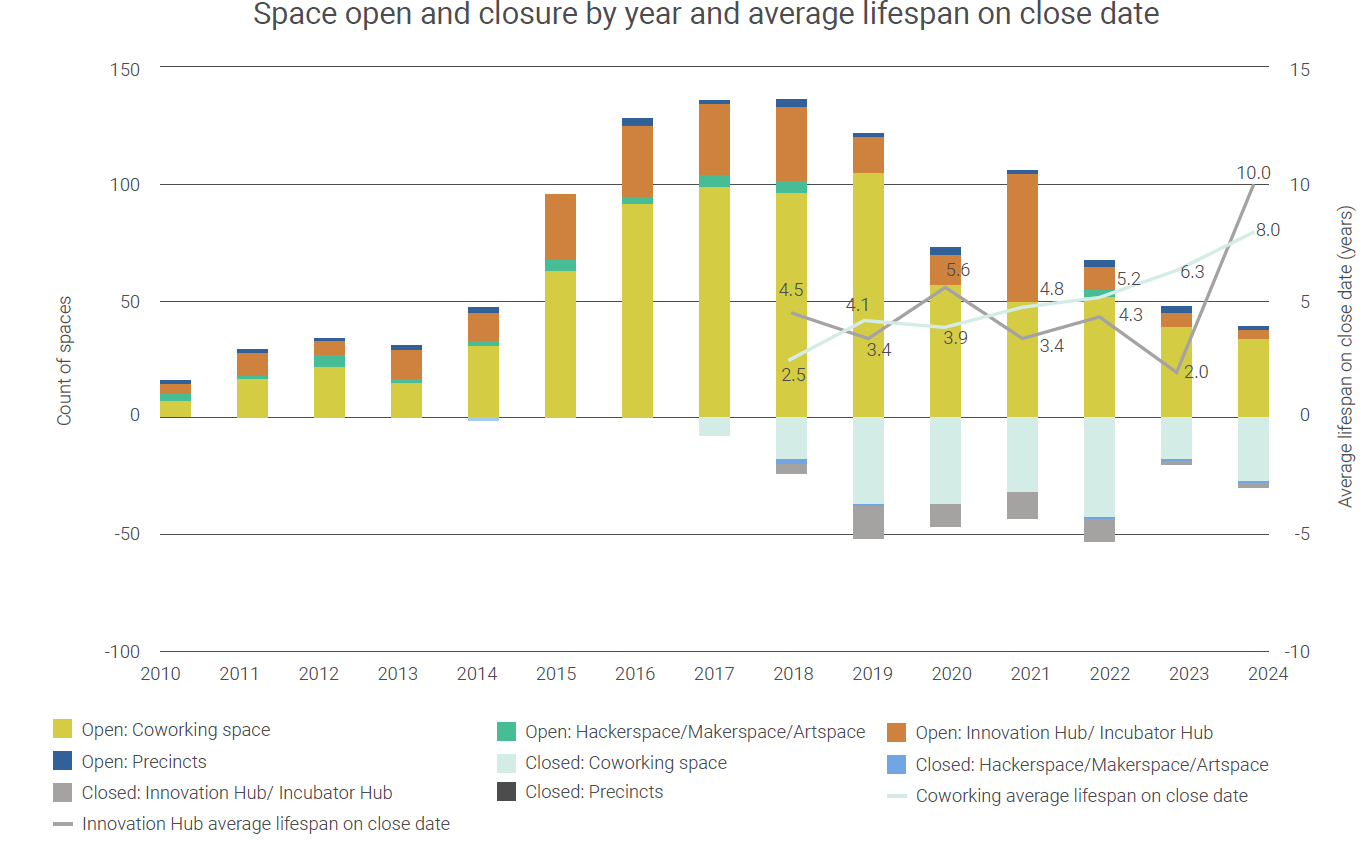

The steady growth of innovation assets accelerated with the federal $1.1 billion National Innovation and Science Agenda and related state government policies. (A list of policies and related impacts can be found in the 2023 article The Evolution of the Australian Start-up and Innovation Ecosystem: Mapping Policy Developments, Key Actors, Activities, and Artefacts). Hubs and spaces grew at a rate of between 20% and 40% per annum from 2010 to 2014. The increase in spaces reflected global trends in workforce changes from the Global Financial Crisis and more accessible technology through social media, mobile platforms, and evolutions in programming languages and interfaces. Government investment saw the rate of increase jump to 50% in 2015, followed by a declining rate of annual growth to a plateau in 2019.

The growth rate of innovation hubs and coworking spaces stabilised after 2020 to between 2% and 4% per annum. Reflecting the influence of policy, the spike in innovation hub growth in 2021 is due to the Future Drought Fund's investment in Drought Innovation Hubs, with eight hubs across Australia, each including up to seven nodes, which each act as an innovation hub.

It would be tempting to attribute the decline in growth rates to the COVID-19 pandemic. In reality, the pandemic and related lockdowns were announced in Australia in March 2020. Other systemic changes around the time included the rise of multi-site and corporate models such as WeWork, Wotso, and Servcorp, the ending of three-year funding programs, and political shifts away from innovation and entrepreneurship.

The impact of the funding cycle is highlighted in an analysis of space closure rates. An innovation hub's lifespan measured at closure is between 3 and 4 years. The lifespan for coworking spaces was similar but is trending upward, reflecting changing business models.

Survival rates

The survival rate can vary depending on the primary funder, defined as one of five sources: government, corporate, university, venture capital, or independent. On average, an independent space or hub has a 75% survival rate, meaning that one in four hubs and spaces will close in any given year. Independent models make up the majority (95.5%) of Australian coworking spaces. Other coworking models, such as corporate and university ones, have a much smaller representation (1.2% and 0.7%) and can be seen as waning, with only a 27% and 40% survival rate. The models with the highest survival rates are government and university-funded innovation hubs, representing 27% and 17% of the total, with survival rates of 96% and 85%.

Space per capita

The reality is that a population will only sustain so many hubs and spaces. This is similar to other 'species' in an ecosystem, such as a chamber of commerce, a neighborhood centre, or a library. This can be moderated by the presence or lack of other related roles and geographic distribution of the population centres.

This can be seen in a review of space and hub numbers per capita across Australian states and territories. While it can be tempting to spruik New South Wales or Victoria as having more hubs and spaces, the count largely correlates per capita. Smaller populations would be expected to have a higher per capita count of spaces due to a base level needed to service a set population level. The ACT may have a slightly higher representation of spaces due to the prominence and maturity of the Canberra Innovation Network, which performs many of the functions of an innovation hub for the territory's smaller population.

What does it mean?

In ecological terms, what we’re seeing is not failure, but natural evolution and a “stabilisation of a new species” - coworking spaces and hubs are no longer novel, but embedded. Their functions are now distributed across the wider ecosystem of business support, education, and real estate.

So, where to from here?

The sector isn’t dying—it’s shifting. We’re moving into an era of:

Specialisation: industry-specific spaces, regional identity-driven hubs, and niche models with clear purpose.

Consolidation: fewer new entrants, but stronger, more resilient operators.

Partnerships over buildings: platforms, networks, and programs that support innovation without needing to own the physical footprint.

The challenge for policymakers, investors, and community leaders is to be strategic if they are considering new spaces and invest in existing spaces to reduce waste and leverage a return on initial capital. The sector is asking for sustainable models, clear value propositions, and alignment with long-term local priorities.

I appreciate the opportunity to support the team at Flexible Workspace Australia including Kate Dezarnaulds and Ophelie Cutier with their annual report. Please have a look at the full report for further analysis and deep insights from other perspectives in the field of flexible workspaces.

The future evolution: Reflecting on emerging forms in regional communities

I will continue to track innovation actors in the Australian innovation ecosystem through Startup Status and apply research through the Rural Economies Centre of Excellence at the University of Southern Queensland. That said, my focus will continue to shift to work with Kerry Grace and Ready Communities on regional place-based applications.

Shared workspaces and innovation collectives take different forms in regional communities. Just this week, I was speaking with a local government councillor who also manages the local food markets that acted as an incubator and hub supporting the development of food and agriculture innovators and entrepreneurs. The distinction is that those involved would unlikely use those words to describe themselves.

We have seen the rise of Country University Centres that perform many of the functions of innovation hubs for convening and connecting young people to entrepreneurial opportunities through higher education. A local chamber of commerce or economic development organisation may offer part of their office as a shared working space. Nearly all regional libraries would provide some form of coworking. A local traditional owner group or Aboriginal Corporation is involved in establishing a hub for emerging Indigenous business founders. I met with an innovation collective in New Zealand based on Māori principles that distinctly differs from anything I have seen in Australia.

When we look past the labels, we realise the functions of regional and remote hubs and spaces are innovative and unique. Innovation and entrepreneurship are often not recognised in regional communities because it is not something they do; it is a way of being.

The rapid growth of spaces and hubs over the past decade came with challenges of inflicting metro-centric models on regional communities and extractive practices of programs taking value out of regions. Moving forward, the work is to take time to observe what is already happening, be open to new emerging forms, and ensure that value is retained in regions.

This is a collective work. Behind each data point in the graphs are people who have funded, created, managed, and used hubs and spaces over the past decade. I look forward to hearing your reflections, corrections, and challenges as we work together to support new approaches to working together in Australia.